Right now risk, as measured by the Gold-to-Silver ratio, is at the same height as it was at the peak of the Dot.com bubble and the top of the housing bubble. It probably isn't a great time to be long the stock market right now without the appropriate hedges in place. I'm not calling for a crash, but I wouldn't be buying risk assets at the moment. Couple this with the second chart showing the S&P bouncing off of two VERY long-term resistance lines and you have the making of at least an intermediate term drop in the markets.

- Bottom line - if you're looking at purchasing a few shares of your favorite stock I would wait a few days to weeks to buy at lower prices.

Long Term Gold-to-Silver Ratio

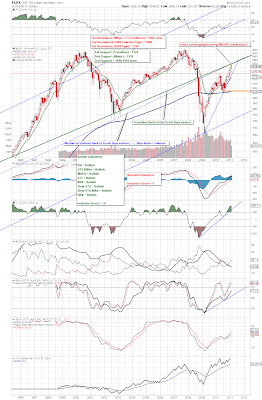

Monthly S&P 500 Index

No comments:

Post a Comment