| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| ||||

Thursday, July 30, 2009

hmmmm? lol

Thursday, July 23, 2009

DTV?

DTV?

Monday, July 13, 2009

Bank index breaking out?

Saturday, July 11, 2009

Thursday, July 9, 2009

Wow!! Is Goldman Stealing $100 Million per Trading Day?

Here’s something to give the conspiracy buffs a total breakdown: Combine these stories from Bloomberg, Daily Kos, and Zero Hedge, and you can reach a rather unsavory conclusion:

• Goldman Sachs’s $100 Million Trading Days Hit Record

• FBI Arrest Opens Goldman-Sachs’ Pandora’s Box

• “Incredibly Shrinking Liquidity” as Goldman Flushed Quant Trading

What is the inference of potentially illegality here?

“That Goldman Sachs may just possibly have used security access codes and built a system to acquire trading information PRIOR to transaction commit time points at NYSE.

The profitability of this split-second information advantage would have been and could have been extraordinary. Observed yielding profits at $100,000,000 a day. [summary to address complaints with respect to complexity.]

GS has special access inside the system from its status assisting the Working Group on Financial Markets (colloquially the Plunge Protection Team) created by Presidential Order two decades ago. GC also acts as Special Liquidity Provider for NYSE.

With 60% dominance of NYSE program trading, what’s good for Goldman defines what shows as overall market performance.”

There is likely to be more info about this trickling out over the coming days and weeks. Stay tuned . . .

Wednesday, July 8, 2009

FDIC Gearing Up for Bank Failures

Via: Washington Business Journal:

The Federal Deposit Insurance Corp. is gearing up to handle a large number of bank failures expected as a result of bad mortgages, both in residential and commercial real estate, an economist said Tuesday.

“They know they’re going to take down a large number of banks and they can’t do it until they’re staffed up,” said Mark Dotzour, chief economist and director of research for the Real Estate Center at Texas A&M University.

Dotzour expects federal regulators to establish an agency, similar to the Resolution Trust Corp. that disposed of assets belonging to insolvent S&Ls in the late 1980s and early 1990s.

“Once they start to sell [foreclosed real estate], we’ll find out what the market really is,” Dotzour told attendees at an economic summit hosted by a handful of real estate groups in Tampa, Fla.

…

Dotzour expects foreclosure rates to continue to climb, real estate prices to fall more and cap rates to rise to at least 9 percent before leveling off.

In 2010 and 2011, interest rates will begin to rise, as will inflation. Once investors realize the market is at bottom, deals will begin to flow again, he said.

In the meantime, he compared the bad loans that remain on banks’ books to a smelly cat litter box and the feds keep throwing more litter on top to mask the smell. But they’ll eventually have to remove the organic material to fix the problem.

It’s Not About U.S.

While the world has been used to the U.S. being the engine that drives global economic growth, this decade we witnessed the resurgence of developing nations with popularized terms such as “Chindia” (China/India) and “BRICs” (Brazil, Russia, India, China). There has truly been a shift in importance coming from developing nations and it is showing on multiple fronts, including share of world market capitalization. The U.S. share of world market cap has fallen from roughly 45% in 2003 to 29% currently, while China’s share has risen from roughly 1% to 9% over the same period. The second chart, of the U.S. dollar, shows how the currency markets are responding to U.S. weakness.

Real Estate Recovery?

July 8 (Bloomberg) -- Commercial properties in the U.S. valued at more than $108 billion are now in default, foreclosure or bankruptcy, almost double than at the start of the year, Real Capital Analytics Inc. said.

There were 5,315 buildings in financial distress at the end of June, the New York-based real estate research firm said in a report issued today. That’s more than twice the number of troubled properties at the end of 2008.

Hotels and retail properties are among the most “problematic” assets following bankruptcy filings by mall owner General Growth Properties Inc. and Extended Stay America Inc., according to the report. The scarcity of credit is causing property defaults in all regions and among every investor type, Real Capital said.

“Perhaps more alarming than the rapid growth in the distress totals is the very modest rate at which troubled situations are being resolved,” the report said.

About $4.1 billion of commercial properties have emerged from distress, according to Real Capital.

“In far more situations, modifications and short-term extensions are being granted, but these can hardly be considered resolved, only delayed,” the study said.

The June figures issued today are preliminary.

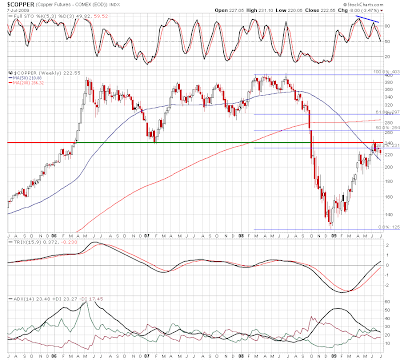

Can Copper keep it up??

Short AAPL

True Unemployment Rate Already at 20%

Via: MSN:

Really, how hard is it to find a job? Was June’s horrid numbers, in which 467,000 people lost their jobs compared to 345,000 in May, a one-time fluke? Or does it mean that all those Wall Street economists who believe the economic recovery is starting are dead wrong?

Not to scare you, but the situation is actually worse than it seems. Over the years, the government has changed the way it counts the unemployed. An example of this is the criticized Birth-Death Model which was added in 2000. The model is designed to account for the birth and death of businesses and the resultant lag in survey data. Unfortunately, the model doesn’t work that well during economic contractions (like we have now) and consistently overstates the number of jobs being created each month.

John Williams of Shadow Government Statistics specializes in removing these questionable tweaks to the government’s statistical data to better align current numbers with the methodology used to gather historical data. After reviewing the data, Williams believes that “the June jobs loss likely exceeded 700,000.” David Rosenberg of Gluskin Sheff notes that the fall in the number of hours worked in June (to a record low of 33 per week) is equivalent to a loss of more than 800,000 jobs.

There are similar issues with the way the unemployment rate is measured. The headline rate only jumped from 9.4% to 9.5% because of a drop in the number of people in the workforce. The more inclusive “U-6″ measure of unemployment, which includes discouraged workers, jumped from 16.4% to 16.5%. But even this doesn’t adequately capture the situation on the ground: Back in the Clinton Administration, the definition of discouraged worker was changed to only include those that had given up looking for work because there were no jobs to be had within the last year.

By adding these folks back in, William’s SGS-Alternate Unemployment Measure rose to a jaw-dropping 20.6%. Separately, the Center for Labor Market Studies in Boston puts U.S. unemployment at 18.2%. Any way you cut the numbers, the situation is very bad. According to David Rosenberg, one-in-three among the unemployed have been looking for a job for more than six months and still can’t find one.

Tuesday, July 7, 2009

Nasdaq breakdown

Nasdaq breakdown

Tech Sector Collapse

America's Fiscal Train Wreck

http://www.morganstanley.com/views/gef/index.html#anchor098c0c3c-6a29-11de-9228-3fb01e8a07e2

Article on Goldman Sachs

Matt Taibbi on how Goldman Sachs has engineered every major market manipulation since the Great Depression

http://www.rollingstone.com/politics/story/28816321/the_great_american_bubble_machine

U.S. debt from a different perspective

demanding a meeting, and you respond by telling them there's nothing to

worry about. Why not? Because you just saved $40 by canceling your

newspaper subscription.

That, essentially, is the kind of fast budget talk President Obama

trotted out in April when he made a big to-do out of instructing his

cabinet to cut $100 million from their budgets.

$100 million may sound like a big number, but the cut would only reduce

the United States' projected $1.8 trillion budget deficit by 0.005% --

less than what you'd save for your mortgage by giving up the daily

paper.

Friday, July 3, 2009

Thursday, July 2, 2009

bear trap?

Pairs trade to play the currency market

Today I am going to put on a pair trade to play this currency pair....

I am entering a long positions in FXY with a stop at $102.50 and a short position in FXE with a stop at $142.50

good trading!!

Short IYR.....stop at $33.50

I am going to short IYR with a stop at $33.50........aggressive players can buy SRS (ultrashort real estate)

The market is currently breaking down as expected...........if it moves lower than 890 the H&S pattern will become a reality and 800 should follow in short order. A look at the advances/decliners shows that there is ample room for more downside.