Also.... Just so we are clear. A 50% reduction in the value of the dollar is not going to be the end of the world if it does materialize. Gold bugs, doom and gloomers, religious zealots, and Fox News would have you believe that if the dollar loses it's value all hell is going to break loose and we will be taking hunting rifles with us to the grocery store. This is just absolutely not true, so quit lying to yourself and others. The dollar falling is what the economy needs to reset itself. It's a natural correction process that needs to happen to rebalance the excesses of the last 30 years and bring manufacturing back to the US. If you disagree with me feel free to e-mail me as long as you have a rational response not memorized from Fox News or any other propaganda machine.

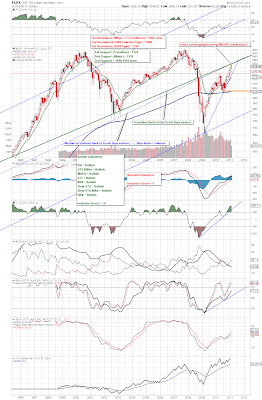

US Dollar Index (monthly)