Source:

M3 Financial Analysis - great work and great blog, republished here

One of the other points I would like to make in regard to come of my earlier posts, is something that has grave impacts economically and for investors. People need to be very active in managing and understanding what is going on in order to protect themselves and understand the real impacts of a potential dollar rally on their purchasing power, assets, and employment.

First and foremost, I would like you to take a close look at this dollar chart. Do you notice anything? Okay, look very carefully at the only significant dollar rally since the Fed has been responsible for the dollar?

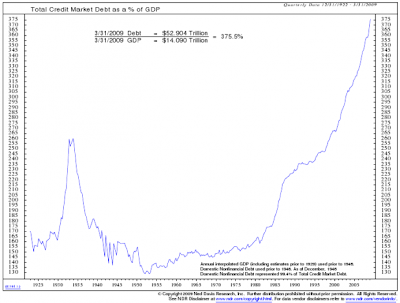

Clearly debt pushing policies inflated asset values from 1913 to 1929. During this time dollar purchasing power declined markedly if you want to call 50% markedly. This was Fed engineered.

There was a reason so many banks popped up during the 20's...and its the same reason that this century has been the era of the banking - so far - THE FED and its conflicts of interest...and fractional reserve lending. Fractional reserve lending is the manner in which 95% of the money in the world is created and the primary dilution factor for the dollar.

Now lets go back to my previous post, in which I refer to the dollar as a certificate representing the corporation of the United States of America. Well, the

dollar IS the stock certificate of the United States...and that certificate is currently not an asset or value, but an IOU.The selling/issuing of dollars through credit (IOU's) - is a short sale that by implication will need to be covered. Its just the same as a short on Pets.com or AIG common shares or ES SP500 futures...the sale of these securities needs to be covered with the purchase of same to close the transaction.

Ron Paul has said it many times, the dollar reserve system has ended and the question is what is next. But the question is also how are all these short sales going to be closed...what kind of mess will that create?

We have appointed people to be responsible for our national value and stock certificates who are the equivalent of appointing a bunch of AIG shorts to run AIG. Additionally, you can tell that the Fed and its governmental co-conspirators have done a terrible job...the chart says they did.

Why are they still employed? Normally you would try to cover your tracks or at least do a bad job, not a catastrophic one, if you were trying to steal from someone while smiling at them at the same time. This dollar chart is catastrophic.

Subsequent to the debt pushing of the 1913 to 1920's, when debt became oversupplied and dollars to service the debt became scarce - as has happened now - we had the only rally in the dollar purchasing power of consequence in nearly 100 years. That rally for the dollar was the great credit contraction called the "Great Depression" - curiously, this was roughly a 27.2% rally.

The Fed used the depression to ensure that their goals would be achieved. The panic of those times led anyone who was scared to the conclusion that its beyond imagination the Fed could engineer such a condition. Worse yet, to be able to conceive that they, instead of attempting to fix the problem, would implement an agenda to make a much bigger one. So, fear led to more and more power which the Fed used to continue to expand its policies - ironically under the guise of preventing a depression which they engineered in the first place.

In achieving these objectives they did an excellent job. Is it any wonder that the SP500 bottomed at 666? I wonder?

Is it any wonder that your Dow Jones Industrials certificates are now worth less in purchasing power in real terms than at the peak of 1929?

So, where to from here? Well, that is a very good question. Look again closely at the dollar chart. Theoretically, the dollar is worth .04 cents. Under a reasonable scenario (

but still a bad one), a short squeeze capitulation rally could take the dollar's purchasing power to between 15 to 30 cents...that could be a 750% increase in the purchasing power of the dollar. I am not going to go into details as to what that would do to the values of stocks, real-estate, and other assets such as silver and other commodities.

Though I really hope to god that none of this happens...

recognizing that it can happen - because it has happened before - is an important thing to do given where we stand currently.There may be some further efforts to fuel a hyper-inflation story. If gold rallies, for instance, people will think that inflation is about to explode...but that rally will likely be short lived.

How Does The Federal Reserve Push The Debt (create money) ?The StoryMoney is created when the factory

(bank) loans you principle. An imbalance is created when you promise to repay money that does not exist - in the form of interest.

I know this is difficult to rationalize. But its the way things work. As long as ponzi scheme bankers can keep giving out loans and increasing the money supply the imbalance is not apparent. Until it is of course.

Now, if I was a smart ponzi scheme banker

(and they are). What I would do is, try to create theoretical money. Imaginary money that everyone believed actually existed and could be used to settle future obligations - such as Warren Buffett's potential $50 billion+ obligation on his european style puts.

(see: Warren Buffett - the ultimate bull-market manifestation)The vast pools of moneyYou have probably heard of the vast global pool of money - its supposed to be around $70 trillion. This pool of money simply trades the debt money created by fractional reserve lending activity -

paper. $70 trillion does not even begin to touch the amount of debt + interest obligations there are in the world. One of the key elements of fractional reserve lending is that once a credit is created...a note or paper is created that represents the value of the borrowers promise to repay and assets he posts as collateral. That is what trades in the vast global pools of money. And as long as the music is playing - everyone is dancing. Credit

(Money), however, is not for the most part created by these pools of money

(theoretically that could represent value and that would not be good for growth). In the majority, it is created by regulation via fiat when fractional reserve lending takes place. And this is why the dollar chart looks the way that it does. The banks have shorted the dollar into oblivion and sold it to suckers who think buying a depreciating asset and paying interest for it is great if they can invest that money in inflating assets that theoretically outperform the depreciation of their dollars. Obviously, this is a hair brained plan and can not work when the music stops. It also blows up when your inflation assets depreciate.

Just to announce it formally - the MUSIC HAS OFFICIALLY STOPPED...but the fed is still dancing.

So this brings is to derivatives. Ok, we have all heard of naked shorting. This essentially means that people are selling shares that don't even exist. I have seen instances where the float of a company was tripled due to naked shorting. This operation creates theoretical shares. This is what the banks do with our financial system every day - only with currency.

Now what are derivatives? Who came up with them? Why did they come up with them?

There are a lot of reasons that people will give as to why a derivative is useful or required.

- Hedging

- Risk Management

- Speculation

But do we need them and why were they created?

Let me answer that question in two parts. Firstly, people who work at banks do not ask themselves what money is. The question seems almost too ridiculous. So, most bank employees can not give you the correct answer as to what money is and how it is created. So, we have a lot of smart people furthering a scheme that they don't even know they are participating in. As long as its not illegal they go along with it.

With derivatives we have a similar situation. A lot of brain surgeon types who never asked essential questions about what the real impacts of their work was. But lets look at what that is.

Theoretical money

- Asset appreciation

- Credit

- Interest on credit

- Modeled Obligations

When stocks or real estate go up, money is created that never existed before. When they go down the opposite happens.

When a loan is given, money is created.

Interest on credit theoretically exists...but the credits (Money) for that interest money need to be created somehow. This is why we need derivatives or vehicles like them, to create the money for the interest due on debt money that is created by banks.

Details:

If I loan $100,000 to someone on a 30 mortgage at 7.5%. I create $100,000 of new money...but the person promises to repay me $251,717.22. So, I need to create $151,717.22 somehow. If on the basis of that issue of credit I create more credit, I will have to create a lot more than $151,717.22. In any case, the only way to create the interest money is to create credit - which creates interest obligations (and that debt money does not exist in the system) and ultimately blows up the system.

Modeled Obligations - to the rescue - they can create money at a whim similarly to how the stock market does...theoretically with no standard interest requirements and very few participants which is rather advantageous when compared to the stock market or other publically owned and priced assets.

If I have a fraudulent money system. I need mechanisms that can create money (Debt) without requiring interest. That's what derivatives are for. And that's why we had 790 trillion dollars of them at one point and why JP Morgan currently has 89 trillion of them on their books (all perfectly hedged mind you).

But what are derivatives?

Derivatives are Modeled Obligations.

- Options

- Futures

- Exotic Agreements

- CDS's

- CMO's

- CDO's

- Structured Products

Options are fairly simple - though spreads and volatility make them complicated. All derivatives have option characteristics. Options themselves do not usually create very much new money.

Futures are also quite simple. However, highly leveraged. With 1 future you can control 40, 50, 60, 80, 100 times the money requirement to trade the future. Guess what? That creates money...theoretically of course. Since you have agreed to take on all the risks of that position - the 100,000 of theoretical money can be written into the books - again theoretically of course. If you look at what it costs you to control that amount of money there is a problem. Clearly this credit is being supplied at such a high discount that there is barely a cost in the standard form of credit issuance. Therefore the money system is creating new money that can be theoretically used to pay the interest on existing credit with money that creates very little interest. Remember, how our money system operates - theoretically - of course.

Most of the other structured products and other derivatives operate on the same basis except even more leveraged and primarily based on ratios of one agreement to another...bundled up as a unit they can considered a single derivative - i.e. a derivative is usually built out of multiple subordinate derivatives.

What's our total debt?

The total dollar debt in the world is roughly in the 350 trillion area...with interest requirements that over the term of those notes requires 500 to 600 trillion of theoretical money to be created...this can be done as I indicated earlier through inflation or through theoretical mechanisms. Derivatives are the Fed authorized/endorsed/promoted mechanisms capable of theoretical money creation that does not implicitly create large interest obligations and can be used to support expanding asset inflation and as a result create enough money to theoretically repay all the interest on the total outstanding obligations.

When Tim Geithner discusses the need for Derivatives regulation, keep in mind that the development of derivatives was explicitly developed under his watch and Greenspan's auspices. These guys knew we needed derivatives. It was their only way out. And they implemented the scheme deliberately, promoting SIV's and off balance sheet transactions and flakey accounting along the way for spice, so that Bank balance sheets could be manipulated and theoretical money could be created without standard interest obligations.

The Fed is the driver of the Fraud. JP Morgan is one of the primary vehicles for it and the most dangerous bank in the world.

Learn as much as you can.

- Watch the dollar. If the dollar breaks out strongly...then we know a bad case or worst case scenario is playing out. For the scenario discussed here to not take place, the dollar MUST sell-off and remain weak. If that does not happen (I know I am repeating) things are going to get very bad.

- Make a plan...do not trust the FDIC...they are the primary enabler of the debt pushers...I heard these two guys on CNBC discussing how "you should not even worry about the FDIC - its backed by the full faith of the US Government." That's called complacency...complacency and investing do not go together. If politicians were rational, we might not have to worry. But if politicians realize that they will be voted out of office for putting the US taxpayer on the hook for another trillion here and another trillion there...we can not be sure that the faith of the government will be there when it's required. I know is seems improbable...but if you told me that we would put the supposedly smartest minds in finance on the job of protecting our purchasing power, managing prices, and protecting the dollar and they would run it into the ground 96% - I would say that is improbable too.

- Watch this movie: Money as Debt. Show it to people you care about.

- Help Ron Paul and Rand Paul defend the Constitution and reign in the Fed

- TRY TO UNDERSTAND THE PROBLEM. THIS IS NOT A LIE. THIS IS NOTHING BUT THE FACTS. PROTECT YOURSELF, ASK QUESTIONS, BE A CONTRARIAN, AND FIRST OF ALL BE A PATRIOT.

"IN A TIME OF DECEIT, TELLING THE TRUTH IS A REVOLUTIONARY ACT."

-George Orwell

-